Smart Office ROI: How Building Automation Systems Reduce Operational Costs in DIFC Towers

- Posted on

- In Tips & Features

In the heart of Dubai’s financial district, DIFC towers are monuments to global commerce, prestige, and ambition. But behind the gleaming glass facades lies a relentless operational challenge: managing astronomical energy consumption, ensuring optimal tenant comfort, and controlling spiraling overheads all while maintaining a competitive edge.

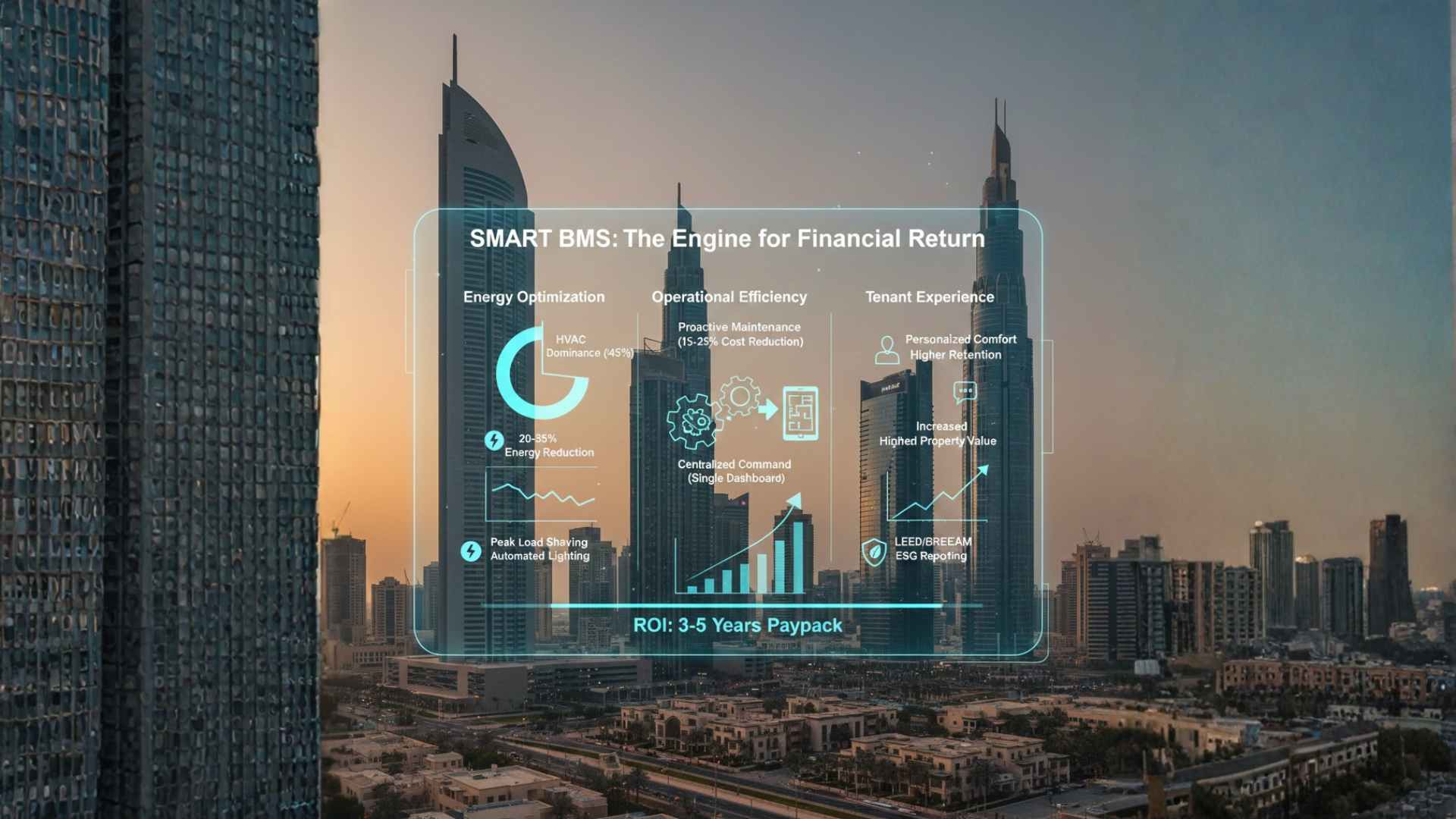

The solution transforming these iconic towers isn’t just a minor upgrade; it’s a strategic overhaul through Building Automation Systems (BAS/BMS). For landlords, facility managers, and tenants alike, a smart BMS is no longer a luxury it’s a powerful engine for financial return on investment (ROI). Here’s how.

The High-Stakes Equation of DIFC Operations

Before the solution, understand the core cost centers:

HVAC Dominance: Cooling can constitute ~40-50% of a building’s total energy use in Dubai.

Peak Demand Charges: DEWA tariffs punish high, short-term power draws.

Tenant Turnover & Churn: Inefficient environments impact tenant satisfaction and retention.

Manual Inefficiency: Reactive maintenance and manual system checks are labor-intensive and imprecise.

A building management system acts as the central nervous system for the tower, integrating and intelligently controlling HVAC, lighting, security, and power. The ROI is multi-faceted.

1. Energy Optimization: The Direct Financial Slash

This is the most quantifiable and significant area of ROI.

Predictive & Adaptive HVAC: Instead of cooling at a fixed schedule, a BMS uses data from thousands of sensors (indoor/outdoor temperature, occupancy, humidity) to deliver cooling precisely where and when it’s needed. It can pre-cool buildings using off-peak night air or adjust setpoints based on real-time occupancy from access control systems.

Peak Load Shaving & Scheduling: The system identifies periods of potential peak demand and strategically staggers the start-up of large equipment (chillers, AHUs) or briefly adjusts temperature setpoints by a degree to avoid costly demand spikes.

Lighting Intelligence: Automated, occupancy-based lighting in common areas, parking garages, and even tenant floors (with permission) eliminates waste. Integration with daylight harvesting sensors maximizes free natural light.

ROI Impact: DIFC buildings with advanced BMS routinely report 20-35% reductions in annual energy consumption. For a tower with an annual DEWA bill in the millions, this translates to savings that can pay for the system itself in 2-4 years.

2. Operational Efficiency: Doing More with Less

Proactive Maintenance: The BMS transitions from reactive to predictive. It monitors equipment performance (chiller efficiency, pump vibrations, filter pressure drops) and flags issues before they cause failure. This prevents catastrophic downtime, extends asset lifespan by years, and reduces emergency repair premiums.

Centralized Command & Control: Facility managers can monitor and control the entire building’s systems from a single dashboard or even a smartphone. This reduces the need for manual patrols and checks, optimizing staff time and allowing a smaller team to manage more effectively.

Data-Driven Decision Making: Instead of guessing, managers use hard data on energy use patterns, tenant occupancy trends, and equipment cycles to make informed capital planning and retrofit decisions.

ROI Impact: Significant reductions in maintenance costs (up to 15-25%), extended capital equipment life, and optimized labor allocation.

3. Tenant Experience & Retention: The Value of “Smart”

In the competitive DIFC leasing market, tenant retention is paramount to stable revenue.

Personalized Comfort Zones: Advanced systems allow tenants individual control over their suite’s temperature within an efficient bandwidth, increasing satisfaction.

Improved IAQ & Wellbeing: BMS constantly monitors and adjusts air quality (CO2, VOCs), a major factor in occupant health and productivity a key differentiator for top-tier companies.

Reliability: Consistent, comfortable environments with fewer hot/cold complaints and system failures directly reduce churn.

ROI Impact: Higher tenant retention rates, increased property valuation, and the ability to command premium rents as a “Grade A+ Smart Building.”

4. Sustainability & Regulatory Compliance: Future-Proofing Assets

DIFC and Dubai have ambitious sustainability goals (Dubai Clean Energy Strategy 2050, DIFC’s own ESG agenda). A BMS provides the auditable data and control needed to:

Achieve Green Certifications: Easily comply with and excel in benchmarks like LEED or BREEAM, which are increasingly demanded by global corporate tenants.

Meet Evolving Regulations: Stay ahead of mandatory energy performance reporting and efficiency standards.

Enhance Corporate Reputation: Tenants can report lower Scope 3 emissions from their leased space, aiding their own ESG reporting.

ROI Impact: Mitigates regulatory risk, avoids future retrofit penalties, and attracts ESG-conscious tenants at a premium.

The Bottom Line: Calculating Your BMS ROI

A modern BMS implementation in a DIFC tower is a capital expenditure with a clear, accelerated payback period.

Typical ROI Calculation Factors:

Capital Cost: Hardware, software, and installation.

Annual Savings: Direct energy cost reduction (the largest component).

Avoided Costs: Reduced maintenance, extended equipment life, and lower staff overtime.

Value-Add Revenue: Higher occupancy rates, premium rental yields, and increased asset value.

The Real-World Verdict: While the payback period varies based on the building’s age and system scope, modernizations typically see a full ROI within 3 to 5 years. For new builds, integrating a BMS from the design phase is even more cost-effective and delivers savings from day one.